Cash Cows:Ĭashcows are the products that have a high market share in a market that has low growth.īelow are few products which have been the cash cow for the company for all these years:Ĭoke: Coke for years has been a market leader in carbonated soft drink segment and a major cash generator for the company. Worlds leading ready-to-drink beverage company, Coca Cola company has more than 500 soft drink brands, from Fuse Tea to Oasis to Lilt to Poweradeorlds, but none of them is anywhere close to coke brand in awareness, revenue, and profit. Let’s check out the BCG Matrix of Coca Cola and what products of the company fall under what Quadrant. They require less cash investment and generate more cash than required.

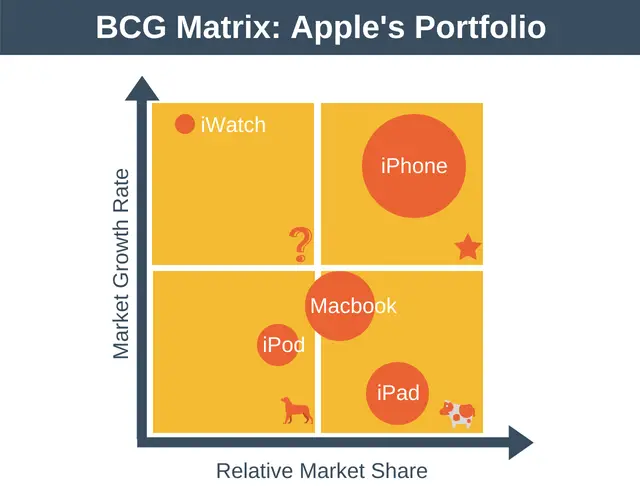

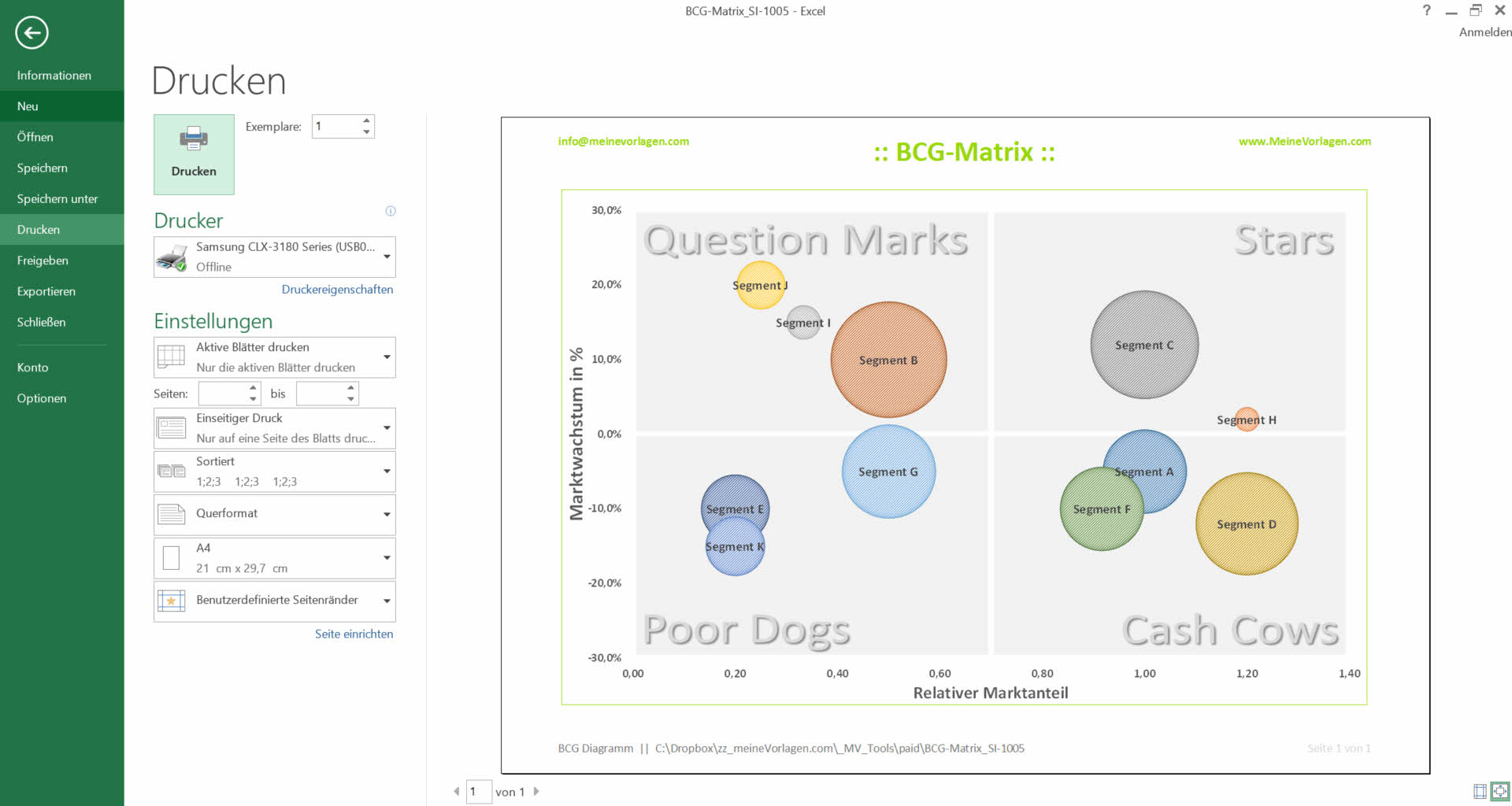

These businesses have a high market share in a low growth industry that is mature not declining nor growing.They are the money churners for the company.They operate in a high growth industry and have a high market share and for this reason, they require high cash investment to maintain its market share.They are the star products or businesses of the company.They are cash traps – Getting a return on investment from these businesses or products is next to impossible.These are the businesses or products which are in the declining stage.They can either become Stars and then Cashcows or and turn in Dogs as well.These business units or products require high capital investment.Most businesses start as Question marks.

Here is a gist of points that we covered about the 4 different quadrants of the BCG Matrix.

The industry has high potential to grow hence giving the room to the products to grow as well only if the pertinent issues are managed effectively. Products or business units of the company that are still in the nascent stage of their product lifecycle and can either become a revenue generator by taking the position of a Star or can become a loss-making machine for the company in the future.

0 kommentar(er)

0 kommentar(er)